Do You Need to Know a Stocks Standard Devaition to Know the Portfolios Standard Deviation

What is Portfolio Standard Divergence?

Portfolio Standard Deviation refers to the volatility of the portfolio which is calculated based on three important factors that include the standard deviation of each of the avails present in the total Portfolio, the respective weight of that private nugget in total portfolio and correlation betwixt each pair of assets of the portfolio.

Interpretation of Standard Deviation of Portfolio

This helps in determining the chance of an investment vis a vis the expected return.

- Portfolio Standard Deviation is calculated based on the standard difference of returns of each nugget in the portfolio, the proportion of each asset in the overall portfolio i.e., their corresponding weights in the full portfolio, and also the correlation between each pair of assets in the portfolio.

- A high portfolio standard deviation highlights that the portfolio risk is high, and return is more volatile in nature and, equally such unstable too.

- A Portfolio with low Standard Deviation implies less volatility and more stability in the returns of a portfolio and is a very useful financial metric when comparison unlike portfolios.

You are free to utilise this paradigm on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Portfolio Standard Deviation (wallstreetmojo.com)

Example

Raman plans to invest a certain amount of money every month in one of the two Funds which he has shortlisted for investment purpose.

Details of which are reproduced below:

- Assuming that stability of returns is most important for Raman while making this investment and keeping other factors every bit abiding, nosotros can hands run into that both funds are having an average rate of return of 12%; however Fund A has a Standard Deviation of eight, which means its average return tin can vary between 4% to 20% (by adding and subtracting eight from the average return).

- On the other hand, Fund B has a Standard Departure of 14, which means its return can vary between -two% to 26% (by adding and subtracting fourteen from the average return).

Thus based on his risk ambition Risk ambition refers to the amount, charge per unit, or pct of risk that an individual or system (every bit determined by the Board of Directors or direction) is willing to accept in exchange for its plan, objectives, and innovation. read more than , if Raman wishes to avert excess volatility, he will prefer investment in Fund A compared to Fund B as it offers the same average return with less amount of volatility and more stability of returns.

| Particulars | Fund A | Fund B |

|---|---|---|

| Average Rate of Return for the Last 3 Years | 12% | 12% |

| Standard Departure | viii | 14 |

Standard Deviation of Portfolio is important as it helps in analyzing the contribution of an individual asset to the Portfolio Standard Deviation and is impacted by the correlation with other assets in the portfolio and its proportion of weight in the portfolio.

How to Summate Portfolio Standard Deviation?

Portfolio Standard Divergence adding is a multi-stride process and involves the below-mentioned process.

Portfolio Standard Deviation Formula

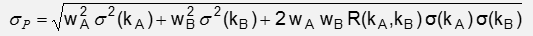

Assuming a Portfolio comprising of two assets only, the Standard Divergence of a Two Asset Portfolio tin exist computed using Portfolio Standard Deviation Formula:

- Find the Standard Deviation of each asset in the portfolio

- Find the weight of each asset in the overall portfolio

- Detect the correlation between the assets in the portfolio (in the above example between the two assets in the portfolio). Correlation can vary in the range of -one to ane.

- Apply the values in the above-mentioned to derive the Standard Deviation formula Standard deviation (SD) is a popular statistical tool represented by the Greek letter of the alphabet 'σ' to mensurate the variation or dispersion of a set of data values relative to its mean (average), thus interpreting the data's reliability. read more than of a 2 Asset Portfolio.

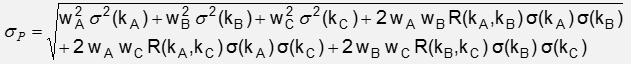

Let's empathize the portfolio standard deviation calculation of a 3 nugget portfolio with the help of an example:

Calculating Portfolio Standard Deviation of a 3 Asset Portfolio

1) – Flame International is because a Portfolio comprising of three stocks, namely Stock A, Stock B & Stock C.

Cursory Details provided are as follows:

| Particulars | Weight Age in Portfolio | Expected Return | Standard Deviation |

|---|---|---|---|

| Stock A | 55% | 8% | 24% |

| Stock B | 25% | 4% | 18% |

| Stock C | 20% | 3% | 15% |

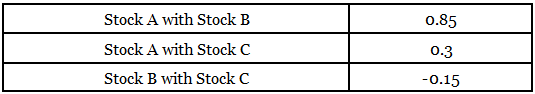

2)– The correlation betwixt these stock's returns are as follows:

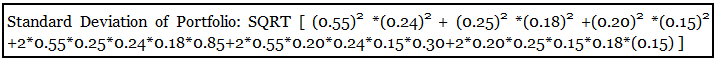

iii)– For a 3 asset portfolio, this is computed every bit follows:

- Where westA, wB, wC are weights of Stock A, B, and C respectively in the portfolio

- Wheres thousandA, south gB, s kC are Standard Difference of Stock A, B, and C respectively in the portfolio

- Where R(kA, kB), R(gA, kC), R( gB, 1000C) are the correlation between Stock A and Stock B, Stock A and Stock C, Stock B, and Stock C, respectively.

- Standard Divergence of Portfolio: 18%

- Thus we can meet that the Standard Deviation of Portfolio is eighteen% despite individual assets in the portfolio with a different Standard Deviation (Stock A: 24%, Stock B: 18%, and Stock C: 15%) due to the correlation between assets in the portfolio.

Portfolio Standard Departure Video

Conclusion

Portfolio Standard Deviation is the standard difference of the rate of return on an investment portfolio and is used to measure out the inherent volatility of an investment. Information technology measures the investment's risk and helps in analyzing the stability of returns of a portfolio.

Standard Deviation of Portfolio is an important tool that helps in matching the run a risk level of a Portfolio with a client's hazard appetite, and it measures the total risk in the portfolio comprising of both the systematic risk and Unsystematic Adventure. A larger standard deviation implies more volatility and more dispersion in the returns and thus more risky in nature. It helps in measuring the consistency in which returns are generated and is a skillful mensurate to clarify the performance of Mutual funds, and Hedge Funds A hedge fund is an aggressively invested portfolio fabricated through pooling of various investors and institutional investor'due south fund. It supports various assets providing loftier returns in exchange for higher risk through multiple risk management and hedging techniques. read more returns consistency.

However, it is pertinent to note here that Standard Departure is based on historical data and Past results may be a predictor of the time to come results, but they may also change over time and therefore tin alter the Standard Deviation, so one should be more careful before making an investment decision based on the same.

Recommended Articles

This has been a guide to what is Portfolio Standard Deviation, its interpretation forth with examples. Also, we larn how to calculate the standard difference of the portfolio (three avails). You may learn more about Nugget Management from the post-obit manufactures –

- Sample Standard Difference Formula

- Relative Standard Deviation Formula

- Portfolio Management Career

- CORREL Excel Function

- Tiptop 10 Best Wealth Direction Books

Source: https://www.wallstreetmojo.com/portfolio-standard-deviation/

0 Response to "Do You Need to Know a Stocks Standard Devaition to Know the Portfolios Standard Deviation"

Post a Comment